Why You Should Pay Yourself First: A DTC Founder’s Guide to Salary and Distributions

As a DTC brand founder, you’re not just selling a product online—you’re building your personal financial future.

Unfortunately, too many founders don’t realize that they may not reach their personal financial goals without an intentional, structured process for paying themselves.

Maybe you’ve said things like:

“I’ll just reinvest everything into the business for now.”

“It’s all going back into growth.”

“I’ll take money out later when things stabilize…”

We hear this all the time. But this mindset creates avoidable problems. You risk burnout, distorted profitability, and a business that only works as long as you work for free.

Salary and Distributions: Two Different Jobs

One of the most common mistakes we see is treating salary and distributions as interchangeable. They’re not.

At Free to Grow CFO, we coach founders to draw a clear line:

Salary is what you get paid for the job you do inside the business.

Distributions are what you earn as the owner of the business.

If you’re the acting CMO, Head of Ops, or CEO, you deserve to be compensated for those responsibilities. That compensation—your salary—should be treated as a P&L line-item cost of running the business, just like paying any other team member.

Distributions, on the other hand, are your share of the profits. They represent return on equity, not payment for services rendered. They’re a reward for building a profitable, enduring company—not a substitute for a salary.

Failing to make this distinction leads to a dangerously misleading financial picture. You might think your business is profitable, but that’s only because you’re quietly subsidizing it with unpaid labor.

The Reinvestment Trap

“I’m reinvesting everything” sounds noble, but often it’s a way of avoiding harder financial questions. Reinvestment without discipline can cover up bloated operating costs, inefficient marketing spend, or over-ordering inventory.

Worse, it puts your personal financial health entirely at the mercy of one asset—your business. That’s not strategy; that’s risk.

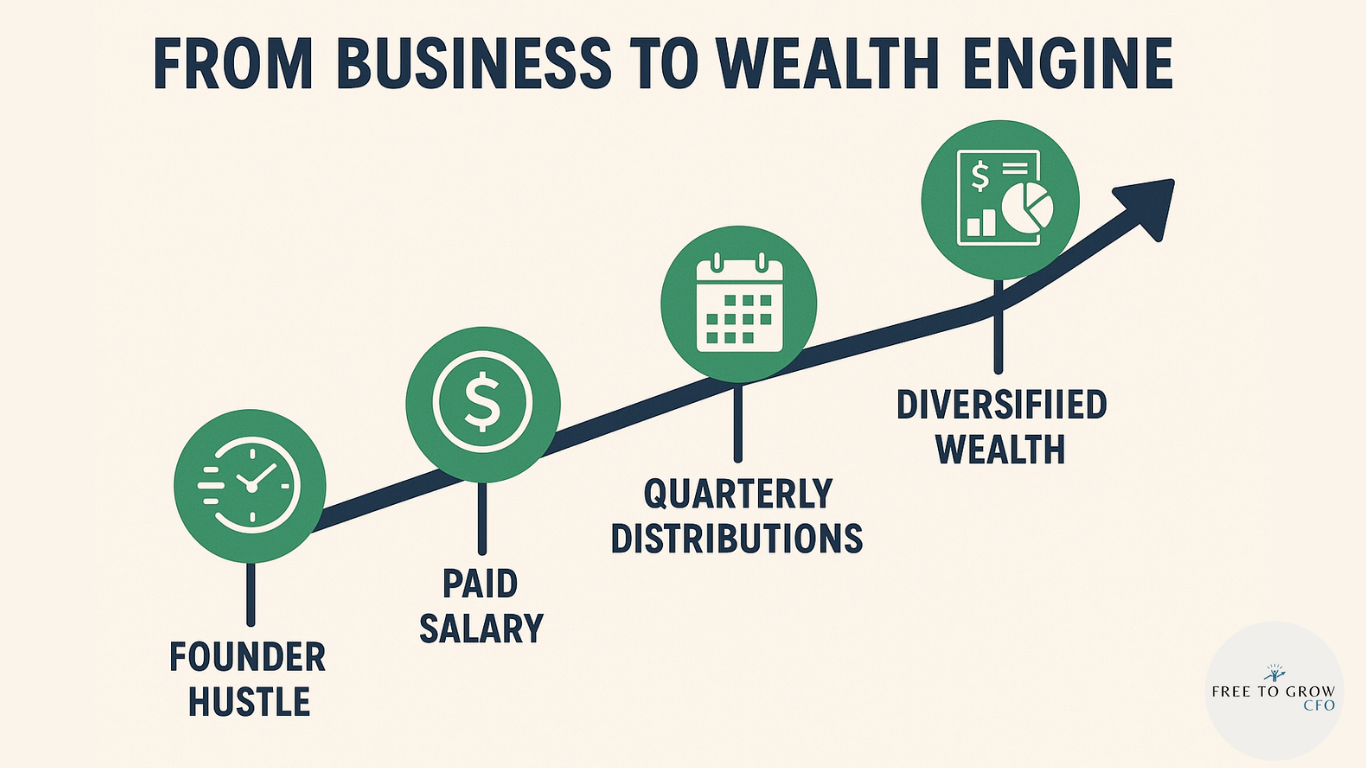

At some point, the goal should shift from building a business to building a business that builds wealth. And that starts with consistent, structured owner compensation.

Build a Simple Compensation Structure

You don’t need a complex financial model to get started. Begin with a two-part framework:

Pay Yourself a Market-Rate Salary

Even if it’s not through payroll (e.g., you’re a sole proprietor or LLC), calculate what it would cost to hire someone to take over your role working inside the business, and track that as an operating expense on your P&L.

Take Quarterly Profit Distributions

Once you’ve paid all your operating expenses—including your salary—distribute a portion of what’s left as owner profit. Don’t wait until “someday.” The habit of paying yourself forces your brand to generate real, sustainable profit and cash flow.

But What If You’re Not Ready?

Many founders worry about taking money out too soon. That’s understandable. But here’s the good news: you can start small and increase over time as you become more comfortable.

If you are really nervous about taking money out of your business, I recommend getting started with small, reversible distributions. What do I mean by reversible? I mean, take the money out and don’t spend it for a few months. Park it in a high-yield savings account that earns 3-4% interest. If your business experiences a cash crunch, you can easily withdraw the distributions and transfer them back into your business account.

But guess what?

You’ll likely find the business doesn’t need the cash and what you’re doing is building a habit of pulling your cash out and forcing the business to run self-sustainably without it.

This is all about intentionally paying yourself first, not last. Physically removing the cash from your business account will force you to think creatively about how to fund your brand’s growth with less cash in the bank.

The key concept you should take away from this?

Constraints breed creative thinking.

Forcing cash constraints are how you pressure-test your financial model. It forces better decisions around hiring, inventory, and marketing spend. It reveals whether your brand is actually cash-flow positive—or just coasting on founder sacrifice.

Final Thought

You’re not just an operator. You’re a business owner – an investor.

A salary compensates you for your time and expertise. Distributions reward you for the risk and value you’ve created as an owner-investor.

Both matter.

The sooner you separate these payment streams and treat them with intention, the sooner your business stops being a job—and starts being a wealth-building asset.

Until next time, scale on!