The Liquidity Ladder — Why DTC Founders Need a New Way to Think About Capital

Ask any founder what keeps them up at night and somewhere near the top of that list will be cash. Not just how much you have—but how quickly you can access it when things get tight.

Liquidity won’t 10x your revenue.

But it can keep you from making a desperate decision at exactly the wrong time.

As your DTC brand grows, the stakes get higher. You’re juggling growth, profitability, and long-term wealth building—all while trying not to let cash flow surprises or marketing hiccups derail the journey. That’s why I’ve started sharing one of the most valuable frameworks I’ve developed for founders: the Liquidity Ladder.

A Founder’s Dilemma: Reinvest or De-Risk?

Let’s say your brand just had a strong quarter. You’ve got extra cash. Now what?

Reinvest into marketing for top-line growth?

Upgrade your warehouse and ops?

Take a distribution and buy index funds?

Hold it in cash “just in case”?

The answer isn’t binary. It’s about building a capital stack that balances return, risk, and liquidity. That’s where the Liquidity Ladder becomes more than a metaphor—it becomes your cash management strategy.

The Real Goal: Maximum Risk-Adjusted Returns

At Free to Grow, we coach founders to think like capital allocators. The best use of cash isn’t always the one that gives the highest return—it’s the one that delivers the best risk-adjusted return.

Yes, your business might out-earn the S&P 500.

But it’s also likely riskier.

You can’t liquidate your Shopify store in 48 hours. You can’t refinance your CAC. And if every dollar you’ve ever made is tied up in inventory and ad campaigns, you’re walking a financial tightrope—without a net.

This is why thinking in terms of liquidity tiers is so powerful. When you structure your capital into layers—from cash on hand to flexible reserves to long-term assets—you give yourself breathing room, optionality, and the ability to move when conditions change.

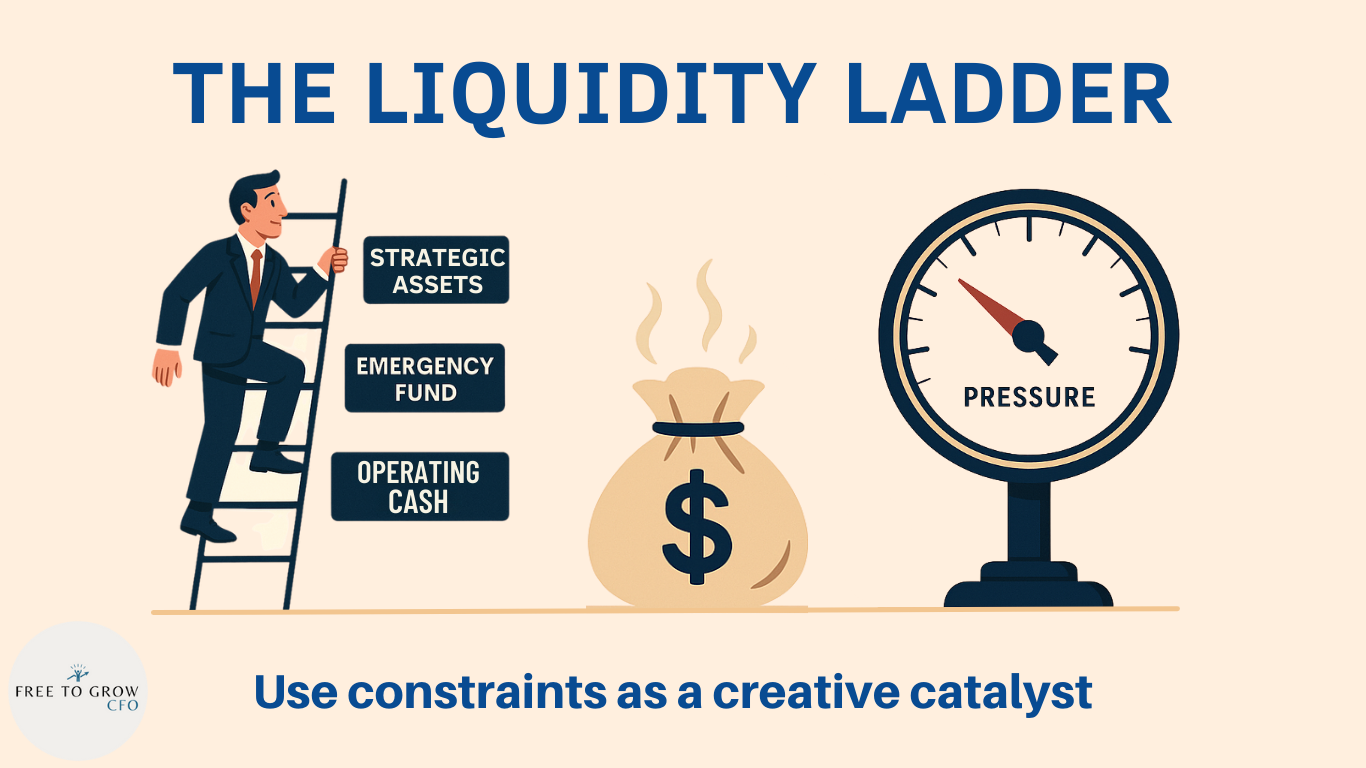

Introducing the Liquidity Ladder

The Liquidity Ladder is a framework for structuring access to your capital—across both your business and your personal life. Each rung represents a different level of liquidity, reversibility, and return:

🔹 Rung 1: Operating Cash

At least 30 days of expenses in checking—business and personal.

This is your daily oxygen. Pay bills, run payroll, stay afloat. No friction. No thinking.

🔹 Rung 2: Emergency Fund

3–6 months of expenses in a high-yield money market account or short-term treasuries.

Accessible in 24–48 hours. Earning ~4%. This is your “don’t panic” buffer.

🔹 Rung 3+: Strategic Assets

Longer-term investments like real estate, index funds, or private equity.

Higher upside. Lower liquidity. These are bets—not bridges.

Liquidity here means how quickly you can access capital when you need to.

Reversibility means how easily you can undo a decision.

And together, they help you control risk while still playing offense.

Factors to Consider When Building Your Ladder

Here’s how to put this cash management mindset into practice—without stalling your growth:

✅ 1. Pay Yourself a Market Salary

Even if you’re a pass-through entity, treat a portion of your earnings as salary. This forces your business to carry the true market value of your role—and helps you understand your true profitability.

✅ 2. Schedule Distributions—Then Create Reversibility

Pay yourself quarterly, even if the amounts are modest. Nervous? Park it in a treasury-backed mutual fund. If you need to put it back into the business, you can. But the discipline of paying yourself keeps pressure on the brand to stay efficient.

✅ 3. Match Liquidity to Risk

The general rule here is – the higher the risk, the more liquidity you want to have access to. Is CAC spiking? Is your product cost volatile? Keep more of your capital in highly accessible cash or equivalents.

Are you growing predictably with a high-retention customer base? Then you might allocate more to longer-term, less liquid investments that build your personal wealth. The bottom line? Align your liquidity with risk.

✅ 4. Use Constraints as a Creative Catalyst

Founders often say they want to be capital efficient—but few force the issue. When you take distributions consistently, you create healthy pressure to optimize spend, cut waste, and improve margins.

🚨 Why It Matters: Liquidity Reduces Risk

Too many DTC founders are overexposed in one direction—fully invested in their brand, cash-strapped in real life, or vice versa. The Liquidity Ladder helps reduce that exposure and offers three key benefits:

Optionality: You preserve the ability to make strategic moves when others can’t.

Reversibility: You can change course when needed—without burning everything down.

Peace of Mind: You stop making fear-based decisions when you’re not backed into a corner.

This isn’t just about protection—it’s about performance under pressure.

Final Thought

Your Liquidity Ladder won’t show up on your P&L. It won’t get reported in your Klaviyo dashboard.

But it may be the single most important tool you build as a founder.

It keeps you sane. It keeps you solvent.

And it helps you grow—not just your business, but your life—with intention.

Until next time, scale on!